It's an Everyday banking account linked to your home loan.

Offset is a feature that you can add to a variable or fixed rate home loan.

A savings a/c earns interest. An offset account doesn’t, it saves you interest.

Let’s use your everyday a/c for pays and spending and rename the word “savings account” and now call it an “offset account”

When get a home loan, you add an offset a/c and make this your new savings a/c.

The home loan now uses your offset a/c balance (the money that you have) to offset your loan balance (the money you owe).The more money you have in your linked everyday offset a/c, the less interest you pay on your home loan!

How it works

When you borrow to buy a home, the bank charges you interest on the amount that you borrow. And when your bank works out the interest amount, you’re usually charged interest on your whole loan balance (ie. the total amount you owe on your home loan).

Having offset changes this.

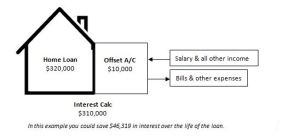

Instead of being charged interest on your full home loan balance, you’re charged interest on your home loan balance minus the amount in your linked offset.

Example $10,000 sitting in your Offset account

For the life of your loan could save you $46,319 and help you to pay off the loan sooner. (Example uses an interest rate of 7.22% per year and a 25 year loan term.)

Interest is calculated every day.

Home loan interest is calculated daily, based on the balance of your loan each day. At the end of each month your lender will total up the interest from each day in that month (and charge it all at once).

Here is the big deal about offset accounts.

Every dollar you have in your offset account saves you interest every day that it’s there.

Plus, you can access money in your normal manner via the internet or EFTPOS or ATMs.

You don’t need to have a lot of money in the bank for an offset account to save you interest. Over the life of your loan, even a small amount in an offset account can save you thousands of dollars.

Example of just $500 in offset.

$400,000 loan with a 30 year term and interest of 7.22% per year you’ll see that always having just $500 in your offset account could save you $3,824.

Start with your wage

An offset account can be beneficial even for those who find it hard to save. You can start by directing your wage directly this account. This way, the money you earn is immediately reducing the interest you pay on your home loan – even if you end up spending some of that money over the cycle of a month.

Say you get paid on the 15th of the month, but your mortgage repayment cycle is on the 28th of each month. You could save the difference in interest on the amount in your account for all the days in between this period every month. In the long term this can add up to thousands.

The trade off: Offset accounts don’t earn any interest

Savings accounts earn interest. Offset accounts don't.

Offset vs savings accounts

When your home loan interest rate is higher than your savings account rate, you are generally better off using offset, and not earning the interest.

You are saving money by paying less interest on your home loan, compared to the interest you’d be earning on a high interest savings account.

Don’t forget that you’d probably have to pay tax on any interest that you earned in a savings account too. An offset account doesn’t earn any interest, you won’t pay this tax by using an offset account (you should check this with your own tax adviser).